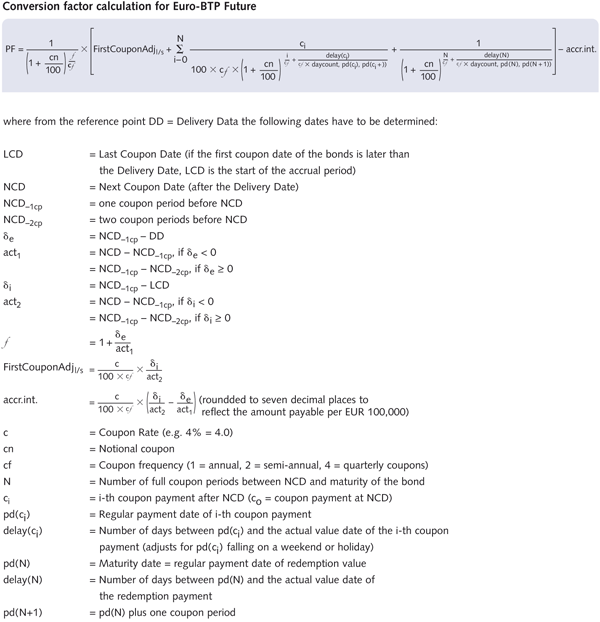

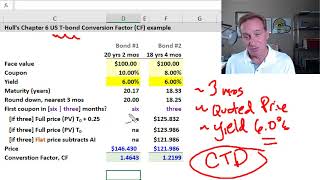

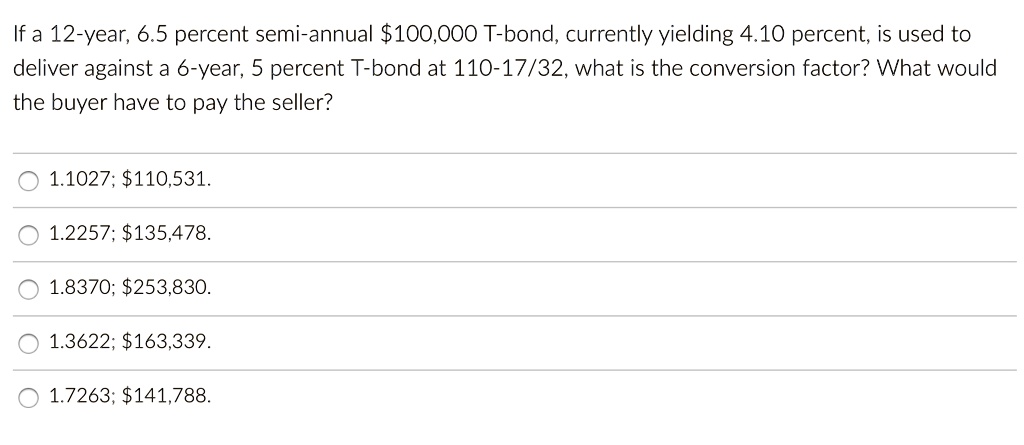

SOLVED: If a 12-year, 6.5 percent semi-annual 100,000 T-bond, currently yielding 4.10 percent, is used to deliver against a 6-year, 5 percent T-bond at 110-17/32, what is the conversion factor? What would

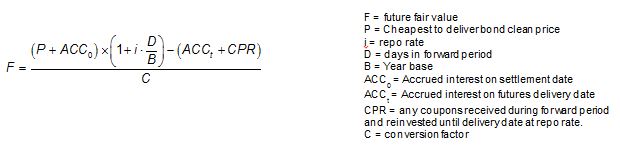

𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐇𝐲𝐩𝐞 on Twitter: "This brings us to the Cheapest to Deliver concept and the page on Bloomberg (DLV<GO>) When you short a fut, you will deliver a bond. You must