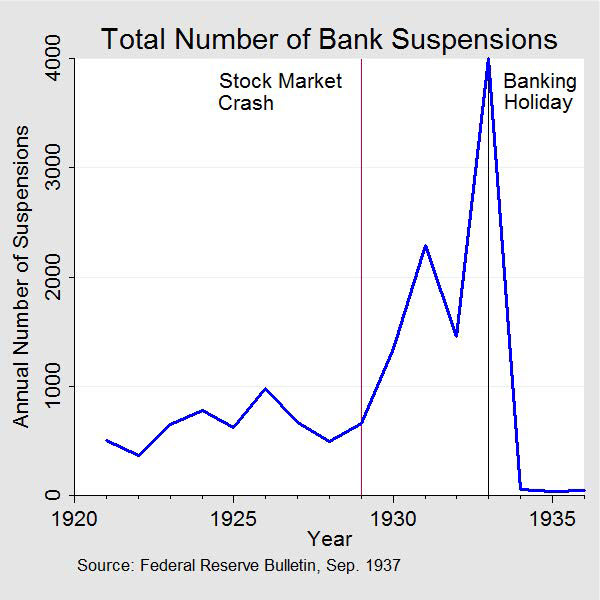

Bulgaria: Financial Sector Assessment Program - Detailed Assessment of Observance on the Basel Core Principles for Effective Banking Supervision in: IMF Staff Country Reports Volume 2015 Issue 295 (2015)

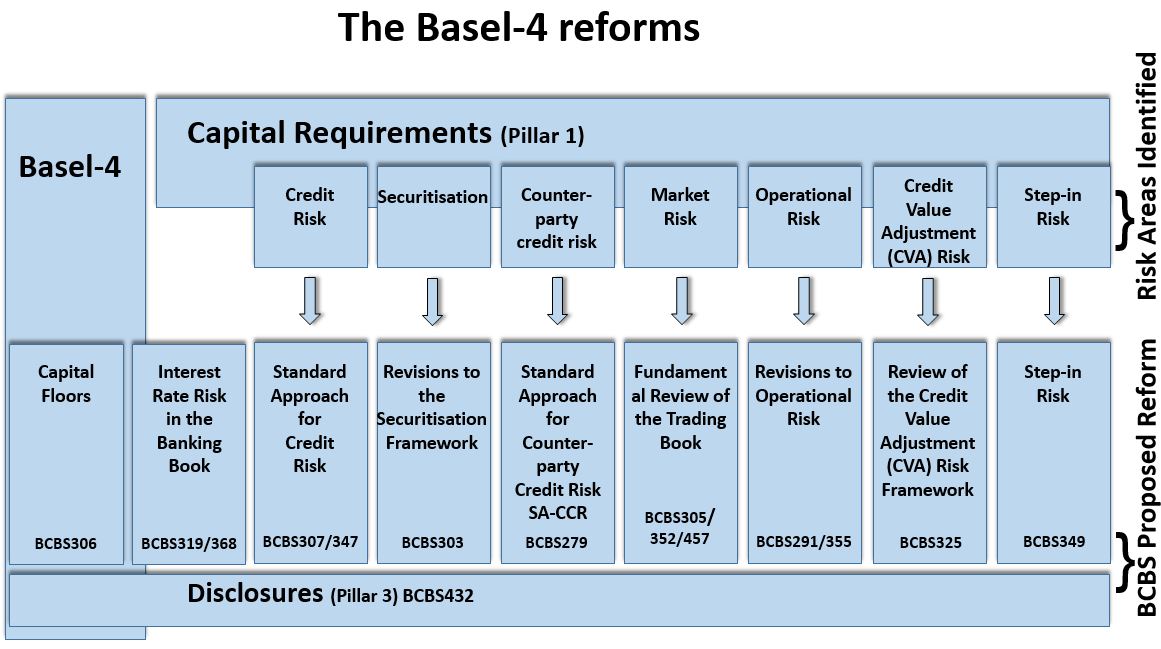

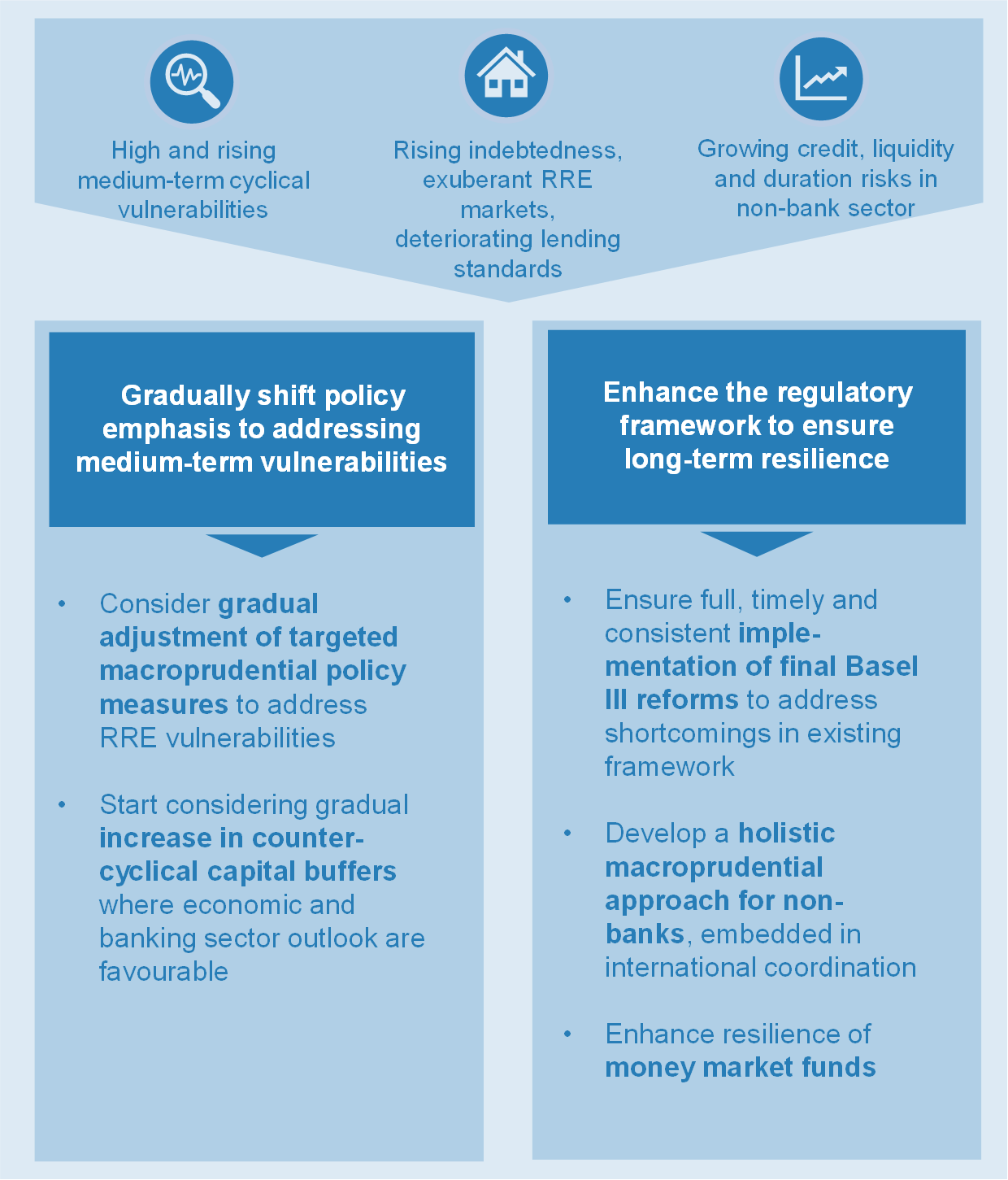

Lecture 2 - Discussion Paper Answers - Lecture 2 – Discussion Paper Developments in the Financial - StuDocu

Risk scoring: Risk Based Supervision in Practice Ross Jones Deputy Chairman, Australian Prudential Regulation Authority President of International Organisation. - ppt download

The Lancet Global Health Commission on Global Eye Health: vision beyond 2020 - The Lancet Global Health

Strengthening Bank Regulation and Supervision: National Progress and Gaps in: Departmental Papers Volume 2021 Issue 005 (2021)

Strengthening Bank Regulation and Supervision: National Progress and Gaps in: Departmental Papers Volume 2021 Issue 005 (2021)

KING MILLZ 🔱 on Twitter: "Following the directive from the Apex bank in July to all DMB's to attain a loan to deposit ratio (LDR) of 60% in order to improve lending

Basel Committee on Banking Supervision. Sound Practices for the Management and Supervision of Operational Risk - PDF Free Download

Lecture 2 - Discussion Paper Answers - Lecture 2 – Discussion Paper Developments in the Financial - StuDocu